We are aware of incorrect information about AIC’s financial assistance schemes being circulated. Always verify details on our website first. If in doubt, contact AIC directly.

ElderShield

Monthly cash payouts to help with long-term care if you become severely disabled.

Highlights

Key criteria

Introduction

ElderShield is a long-term care insurance scheme for Singaporeans and PRs who become severely disabled.

The monthly payout can be used for long-term care needs, such as hiring a helper, paying for care services, or daily expenses.

As of 1 January 2020, this insurance scheme has stopped accepting new sign-ups.

How to qualify

There are a few criteria your loved one will need to meet to qualify for ElderShield claims.

| Criteria | Description |

| Care recipient’s coverage |

He/ she must be an ElderShield policyholder.

|

| Care recipient’s needs |

He/ she must:

|

How the scheme works

Here is how much you can claim from ElderShield as long as your loved one meets the eligibility criteria to receive payouts.

| ElderShield 300 | ElderShield 400 | |

| If the care recipient joined ElderShield between 30 September 2002 and 29 September 2007 | If the care recipient joined ElderShield between 30 September 2007 and 31 December 2019 | |

| Payout Amount | $300 a month | $400 a month |

| Payout Duration | Up to 60 months | Up to 72 months |

After you submit your application, we may take up to four weeks to process it. You will be informed about the outcome in writing via mail.

Once approved, payouts will be made to the nominated bank account in the following month. This may include payouts from the month the application was submitted. The payouts will be reflected as “ElderShield” in your bank statement.

How to apply

There are several ways you can apply for ElderShield claims.

-

Apply online using Singpass (recommended)

This is done via AIC’s e-Services for Financing Schemes (eFASS). We recommend this method as the approval waiting time is shorter.

Read the terms and conditions before you start.

Please read here if you are applying for the grant on behalf of someone who lacks mental capacity.

-

Seek assistance from the nursing home your loved one is staying in

If you are applying for ElderShield to help you offset the cost of the nursing home fees, you can ask the service provider to help. You can nominate the payout to be made directly to the nursing home.

-

Apply via hard copy

Email apply@aic.sg to obtain a copy of the application form or visit any AIC Link.

We seek your understanding that hardcopy applications take a longer time to process.

Documents needed

The full details of what is needed are available on eFASS.

FAQs

He/ she will need to see an MOH-accredited severe disability assessor who will determine their disability level.

There is an assessment fee you will need to pay first, which will be refunded if your loved one is assessed to be severely disabled.

If he/ she is found to have mild or moderate disability instead, there are other financial assistance schemes that you can turn to for help, like the Home Caregiving Grant or MDW Levy Concession. Please find out more about the other financial assistance schemes here.

The cost of the assessment ranges from $100 (if you visit the assessor’s clinic) to $250 (if the assessor needs to do a home visit).

You will need to pay the assessment fee first to the assessor. The amount will be reimbursed if your loved one is assessed to be severely disabled.

The assessment must be done by a MOH-accredited severe disability assessor.

You need to be assessed by an MOH-accredited severe disability assessor.

Please check if your doctor or therapist is on the approved list of assessors. If they are not, please make an appointment with another assessor from the list.

You can apply on behalf of your loved one as long as:

- You are the appointed Donee (appointed under the Lasting Power of Attorney) or Deputy (appointed under the Mental Capacity Act) authorised to make decisions on his/ her property and affairs.

- If your loved one does not have a Donee or Deputy, you can apply on his/ her behalf if you are an immediate family member (parent, spouse or child. Otherwise, you can only apply on his/ her behalf if the immediate family members are unable to do this (eg deceased, lack mental capacity or other issues). For successful applications without a donee/ deputy, the caregiver or another family member has 12 months to obtain a court order appointing him/her as a deputy, failing which the payouts will be suspended. Do visit the Singapore Courts website to find out how to apply for a deputyship.

- You may need the following documents:

-

Recent medical report stating that he/ she lacks mental capacity

OR

Doctor’s certification that he/ she lacks mental capacity

- If the care recipient is also going for a disability assessment, you must ask if the doctor can do a mental capacity assessment (using this form) at the same time.

- The doctor’s certification is valid for six months, unless stated as permanent.

OR

Court order of deputy appointment

- Copy of bank book or statement if the bank account nominated to receive the grant belongs to a deputy or trustee.

No, as such conditions affect people’s ability to carry out the six activities of daily living at different levels.

In order to qualify for ElderShield claims, your loved one still needs to undergo a disability assessment by an MOH-accredited severe disability assessor. The assessor will consider the impact of your loved one’s cognitive challenges as part of the assessment.

Yes, you can reapply and receive ElderShield payouts again if your loved one is assessed to meet all the eligibility criteria.

To change scheme details

Log in with Singpass on eFASS. Go to “Manage My Schemes” > “Change in Scheme Details.”

If you are updating the details for someone who lacks mental capacity for the first time, please read here.

To change the payee to a nursing home that the care recipient is living at

If you are using the ElderShield to offset the cost of the nursing home fees, you can ask for the payout to be made directly to the nursing home.

For this change in payee, please approach the nursing home your loved one is residing at to help you submit the “Change in Application Details” Form to AIC.

Do keep a copy of the application documents for your own reference.

To stop receiving payouts

Log in with Singpass on eFASS. Go to “Manage My Schemes” > “Change in Scheme Details.”

If you are unable to do any of the above online, email apply@aic.sg to obtain a copy of the application form or visit any AIC Link. We seek your understanding that hardcopy applications will require a longer approval waiting time.

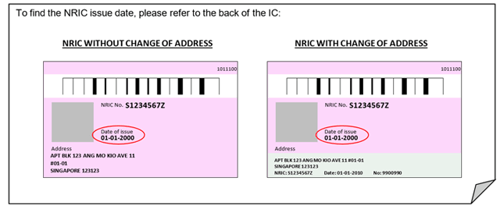

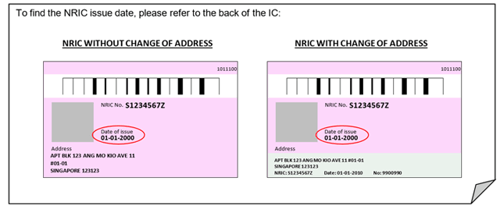

AIC needs the NRIC issue date for verification. You can find it on the back of your NRIC card.

Visit SG Enable’s Enabling Guide, an online resource for persons with disabilities and their caregivers, as well as professionals looking for disability support.

FAQs

He/ she will need to see an MOH-accredited severe disability assessor who will determine their disability level.

There is an assessment fee you will need to pay first, which will be refunded if your loved one is assessed to be severely disabled.

If he/ she is found to have mild or moderate disability instead, there are other financial assistance schemes that you can turn to for help, like the Home Caregiving Grant or MDW Levy Concession. Please find out more about the other financial assistance schemes here.

The cost of the assessment ranges from $100 (if you visit the assessor’s clinic) to $250 (if the assessor needs to do a home visit).

You will need to pay the assessment fee first to the assessor. The amount will be reimbursed if your loved one is assessed to be severely disabled.

The assessment must be done by a MOH-accredited severe disability assessor.

You need to be assessed by an MOH-accredited severe disability assessor.

Please check if your doctor or therapist is on the approved list of assessors. If they are not, please make an appointment with another assessor from the list.

You can apply on behalf of your loved one as long as:

- You are the appointed Donee (appointed under the Lasting Power of Attorney) or Deputy (appointed under the Mental Capacity Act) authorised to make decisions on his/ her property and affairs.

- If your loved one does not have a Donee or Deputy, you can apply on his/ her behalf if you are an immediate family member (parent, spouse or child. Otherwise, you can only apply on his/ her behalf if the immediate family members are unable to do this (eg deceased, lack mental capacity or other issues). For successful applications without a donee/ deputy, the caregiver or another family member has 12 months to obtain a court order appointing him/her as a deputy, failing which the payouts will be suspended. Do visit the Singapore Courts website to find out how to apply for a deputyship.

- You may need the following documents:

-

Recent medical report stating that he/ she lacks mental capacity

OR

Doctor’s certification that he/ she lacks mental capacity

- If the care recipient is also going for a disability assessment, you must ask if the doctor can do a mental capacity assessment (using this form) at the same time.

- The doctor’s certification is valid for six months, unless stated as permanent.

OR

Court order of deputy appointment

- Copy of bank book or statement if the bank account nominated to receive the grant belongs to a deputy or trustee.

-

No, as such conditions affect people’s ability to carry out the six activities of daily living at different levels.

In order to qualify for ElderShield claims, your loved one still needs to undergo a disability assessment by an MOH-accredited severe disability assessor. The assessor will consider the impact of your loved one’s cognitive challenges as part of the assessment.

To change scheme details

Log in with Singpass on eFASS. Go to “Manage My Schemes” > “Change in Scheme Details.”

If you are updating the details for someone who lacks mental capacity for the first time, please read here.

To change the payee to a nursing home that the care recipient is living at

If you are using the ElderShield to offset the cost of the nursing home fees, you can ask for the payout to be made directly to the nursing home.

For this change in payee, please approach the nursing home your loved one is residing at to help you submit the “Change in Application Details” Form to AIC.

Do keep a copy of the application documents for your own reference.

To stop receiving payouts

Log in with Singpass on eFASS. Go to “Manage My Schemes” > “Change in Scheme Details.”

If you are unable to do any of the above online, email apply@aic.sg to obtain a copy of the application form or visit any AIC Link. We seek your understanding that hardcopy applications will require a longer approval waiting time.

AIC needs the NRIC issue date for verification. You can find it on the back of your NRIC card.

Visit SG Enable’s Enabling Guide, an online resource for persons with disabilities and their caregivers, as well as professionals looking for disability support.